The Informal Economy in Nigeria: Fostering Growth Amidst Economic Changes

The informal economy in Nigeria has long been a critical component of the nation’s economic landscape, playing a multifaceted role in driving employment, income generation, and economic resilience. In recent times, as Nigeria grapples with significant economic changes, including subsidy removal and a floating forex regime, the informal sector’s importance has become even more pronounced. The significance of the informal economy and its contributions to the nation is currently faced with many challenges, with the appointment of a new Minister of Trade and Industry, there is an expectation for new government initiatives aimed at supporting and enhancing this vital sector.

The Nigerian Informal Economic Structure: Current Economic Changes

The informal sector in Nigeria encompasses a wide range of economic activities, from small-scale agriculture and street vending to artisanal production and services. Its significance cannot be overstated. According to data from the National Bureau of Statistics, the informal sector accounted for approximately 80% of Nigeria’s total employment and over 40% of its GDP in 2020.

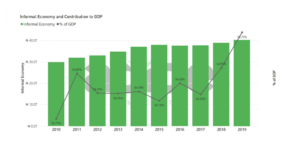

The formal economy, valued at #72,094.08 billion in 2019, represents the officially recognized and regulated economic activities. The informal (shadow) economy, valued at #40,181.29 billion in 2019, encompasses unregulated and untaxed economic activities. This sector operates outside formal channels, often due to various factors such as limited access to legal frameworks, bureaucratic barriers, and informality being a means of survival for many individuals.

The consistent contribution of the informal economy, ranging from 54% to 56% of the total GDP, underscores its significant role in the overall economic landscape. This suggests a sizable portion of economic activities occur outside formal recognition. This high percentage indicates a substantial reliance on informal economic activities for livelihoods and emphasizes the need for policies to acknowledge and support this sector.

The informal sector is also a major source of income for many Nigerians. According to a study by the World Bank, the informal sector generates over 50% of household income in Nigeria. This substantial contribution to employment and economic output underscores the sector’s resilience and adaptability.

The 37.5 million people employed in the informal sector in 2019 highlight its critical role in providing employment opportunities. This sector often serves as a safety net for those who may face barriers in accessing formal employment and as an entry point for many into the broader economy.

However, it’s crucial to note that informality in employment can be associated with lower job security, limited access to social benefits, and potential exploitation, underlining the need for policies that aim to improve conditions in this sector.

Challenges Facing the Informal Sector

- Access to Finance: One of the primary challenges faced by informal sector businesses is limited access to finance. Many operate on a cash basis and lack collateral for loans from formal financial institutions.

- Taxation: Tax collection from the informal sector remains a complex issue. Informal businesses often escape the tax net due to their unregistered status, resulting in revenue losses for the government.

- Regulation and Informality: Informal sector businesses operate largely without regulatory oversight. This can lead to issues such as poor product quality, unfair labor practices, and environmental concerns.

Nigeria has faced economic changes, including fuel subsidy removal and the adoption of a floating forex regime. While these measures were taken to address fiscal concerns and stabilize the economy, they have had implications for businesses, especially in the informal sector. Subsidy removal led to increased fuel prices, impacting transportation costs and the prices of essential goods. Meanwhile, the floating forex regime introduced exchange rate fluctuations, affecting the cost of imported goods and raw materials.

These challenges are likely to harm the formal sector, which is more reliant on imported inputs and fuel. The informal sector is more resilient to these challenges, as it is less reliant on imported inputs and fuel. The informal sector is also more flexible and adaptable than the formal sector. As a result, the informal sector is likely to play an increasingly important role in the Nigerian economy in the coming years.

Government Initiatives to Boost the Informal Sector

The Minister of Trade and Industry has expressed commitment to support the informal sector and aid NMSMEs (National Micro, Small, and Medium Enterprises) in scaling up for positive development. Several government initiatives have previously been launched to enhance productivity in the informal sector:

- MSME Development Fund: The Central Bank of Nigeria established this fund to provide low-interest loans and financial support to micro, small, and medium-sized enterprises, including those in the informal sector.

- Ease of Doing Business Reforms: The government has implemented reforms aimed at simplifying business registration processes, making it easier for informal businesses to formalize their operations.

- Taxation Reforms: Efforts to streamline tax collection, such as the introduction of the Finance Act, have been made to bring more informal businesses into the tax net while providing incentives for compliance.

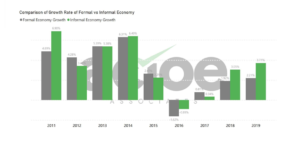

The informal economy has exhibited higher growth rates compared to the formal economy over the years. In 2019, the informal economy grew by 3.71%, surpassing the formal economy’s growth rate of 2.21%. This trend suggests that despite facing challenges such as lack of regulation and access to formal resources, the informal sector demonstrates resilience and adaptability, potentially driven by factors such as flexibility and low entry barriers.

The government can also play a key role in supporting the informal sector and helping NMSMEs to scale up by:

- Reducing regulatory burdens: The government can reduce the regulatory burden on NMSMEs by simplifying regulations and reducing the amount of time and money it takes to comply with them.

- Formalization Strategies: Develop policies that incentivize and facilitate the transition of informal enterprises into the formal economy, focusing on reducing bureaucratic hurdles and providing tailored support to micro and small businesses.

- Inclusive Growth Initiatives: Implement inclusive policies that ensure benefits of economic growth are distributed equitably, targeting vulnerable populations often engaged in informal activities. This could include access to education, healthcare, and social protection programs.

- Regulation and Enforcement: Strengthen regulatory frameworks to oversee and regulate informal activities, ensuring fair labor practices, occupational safety, and taxation, while minimizing unnecessary burdens on small-scale enterprises.

- Skills Enhancement and Training: Establish training programs aimed at enhancing the skills and productivity of workers in the informal sector, aligning with market demands to increase their competitiveness.

- Promoting Entrepreneurship: Create an enabling environment for entrepreneurship, providing access to finance, mentorship, and market linkages, fostering the growth of small businesses, and facilitating their transition into the formal economy.

In addition to these general measures, the government can also implement specific initiatives to support the informal sector. For example, the government could provide subsidies for the purchase of equipment and machinery, or it could establish tax breaks for NMSMEs.

Government Initiatives From Other Countries

Several other countries have implemented successful initiatives to support the informal sector. For example, the government of India has established the Micro Units Development and Refinance Agency (MUDRA), which provides loans to micro and small enterprises. The government of Brazil has also established several programs to support the informal sector, including the Microenterprise Support Program (PRONAMPE) and the Small Business Program (SEBRAE).

- Micro Units Development and Refinance Agency (MUDRA) – India

MUDRA was launched by the Government of India in 2015 to provide financial support to micro and small enterprises (MSEs). It offers three types of loan products – Shishu, Kishor, and Tarun – catering to different stages of business growth and funding requirements.

MUDRA loans are provided through various banks, microfinance institutions, and non-banking financial companies (NBFCs). The initiative aims to promote entrepreneurship and generate employment opportunities in the informal sector by providing access to credit and financial services.

- Microenterprise Support Program (PRONAMPE) – Brazil

PRONAMPE is a Brazilian government program launched to provide support to micro and small businesses, including those in the informal sector. It offers favorable credit conditions, such as low interest rates and longer repayment terms, to help small businesses access capital.

PRONAMPE has been particularly important in helping businesses weather economic challenges, such as those posed by the COVID-19 pandemic.

- Small Business Program (SEBRAE) – Brazil

SEBRAE is a Brazilian institution dedicated to supporting micro and small businesses. It provides various services, including training, consulting, and access to market information, to help entrepreneurs in the informal sector improve their businesses.

SEBRAE plays a significant role in fostering entrepreneurship and providing guidance to small business owners, which is essential for the growth of the informal sector.

In conclusion the informal economy in Nigeria plays a pivotal role in the nation’s economic landscape, serving as a driving force for employment, income generation, and overall economic resilience. Its significance cannot be overstated, as it accounted for a substantial portion of both employment and GDP in the country in recent years. However, the informal sector faces several challenges, including limited access to finance, complex tax collection issues, and a lack of regulatory oversight. These hurdles underscore the need for government intervention and supportive policies to ensure its sustainable growth and development.