Balancing FX Market Stability with Export Promotion: Analyzing Non-Oil Exports

The foreign exchange (FX) market is critical in determining a country’s economic outlook in the global economy. The Nigerian FX market has been volatile in recent months, with the Naira oscillating versus significant currencies such as the USD and EUR. Several variables contribute to this, including global oil price volatility, investor confidence, FX demand, and CBN policy direction.

Other explanations for prevalent trends include the parallel market and limited liquidity, which limit access to specific sectors such as manufacturing and small enterprises. Despite some efforts to alleviate the negative direction of the FX market, these tendencies impede import and export-dependent industries and economic growth.

Synopsis of Nigerian FX Market: Overview of Recent FX Market Trends

The Naira has depreciated against major currencies, such as the US dollar, driven by factors such as high demand & low access to foreign currencies, dependence on oil as the major source of foreign exchange earnings, rising inflation, erosion of purchasing power, reduced investment and pressure on businesses. Trade wars, geopolitical conflicts, and rising interest rates in developed economies contribute to global risk aversion, resulting in capital flight from emerging markets such as Nigeria. Inflation, fiscal pressures, and a lack of foreign exchange reserves contribute to the Naira’s depreciation.

Until June 2023, the Central Bank of Nigeria (CBN) maintained a multi-exchange rate system. In an important step toward unification, the CBN eliminated segmentation in the foreign exchange market and consolidated all rates into the Investors and Exporters (I&E) window. This means Nigeria now has a free-floating currency rate system.

However, Nigeria maintains a parallel market rate and the official exchange rate. This parallel market occurs outside regulated channels and frequently includes unofficial currency transactions. This market’s rates often exceed the CBN’s official rates, however low. It is critical to note that the parallel market’s survival, despite the CBN’s efforts to close other FX windows, is mainly owed to a lack of access, particularly for individuals and enterprises in the export industry.

The naira to dollar rate continues to fluctuate, with the highest exchange rates ranging between ₦1200 and ₦1000 per dollar. However, compared to the over 50% increase in the exchange rate from October 2023 to March 2024, the month of April has seen a downward trend in the dollar rate. Despite this development, uncertainty about future market rates still discourages investment in export-oriented sectors.

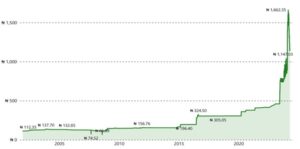

Nigeria $/₦ Exchange Rate from 2004-2024

Over the past two decades, there has been a negative correlation between exchange rates and Nigeria’s economic growth, with inflation and an unpredictable FX market contributing to this decline. This indicates that rising prices and exchange rates are bad for Nigeria’s economy as a whole.

Due to the rising cost of resources, businesses continue to take out loans regardless of the increase in interest rates. However, to cope with the cost, companies might take shortcuts by lowering the quality of products or raising customers’ prices to cover increasing borrowing charges.

Central Bank of Nigeria Interventions

The Central Bank of Nigeria (CBN) has actively supported the foreign exchange (FX) market to address currency stability and liquidity, manage risks, and stabilize the Nigerian financial system. Several noteworthy recent initiatives include:

- On January 30, 2024, the CBN changed the method for calculating the daily official exchange rate, effectively devaluing the naira. The naira traded at NGN 1,192 per USD that day, 25% weaker than the previous day.

- On January 31, 2024, the CBN released a circular harmonizing foreign currency exposure reporting for banks and directing banks to sell excess dollars.

- In February 2024, the CBN also issued new regulations and policies restricting banks and fintech operations in the international money transfer market (IMTO), permitting them to act only as agents. Dollar payments for personal or business travel allowance are no longer remitted in cash.

- International Oil Companies (IOCs) are now regulated to repatriate only 50% of their forex proceeds to their patent companies immediately, with the remaining 50% to be repatriated 90 days after the date of inflow.

The naira fell 30% to trade at about NGN 1,200 per USD in March 2024. These devaluations aimed to stabilize the currency, draw foreign exchange, and liberalize the market. The currency then made new all-time lows, sharply narrowing the difference with the parallel market rate; the CBN’s proactive actions indicate a solid commitment to managing the foreign exchange market.

The Significance of Non-Oil Exports: Contributions to GDP

Nigeria’s non-oil exports increased significantly in 2022, totaling $4.82 billion. This remarkable 39.91% increase demonstrates the nation’s determination to diversify its economy outside of the oil industry.

Semi-processed/manufactured goods made up 36.61% of all exports, which was more than the amount of non-oil exports from the agriculture sector (30.12%). Contributions from other categories came to 13.21%, with precious stones making up 17.06%.

Urea/fertilizer emerged as the most exported commodity, accounting for 32.87% of the total. The geopolitical environment, particularly the crisis between Russia and Ukraine, was conducive to Nigeria’s exports of fertilizer and urea. With 122 countries receiving these exports, Brazil topped the list regarding import value (12.27%). December accounted for 10.37% of the total export value.

Unfortunately, no African country made it into the top 10 buyers of Nigerian goods. By establishing the African Continental Free Trade Area (AfCFTA), the Nigerian Export Promotion Council (NEPC) aggressively seeks to increase intra-African commerce. Enhancing non-oil exports within the ECOWAS sub-region is the goal of programs such as the Export Trade House and participation in international trade shows.

Diversification Benefits

- Stability and Resilience

- Job Creation and Employment

- Increased Foreign Investment

- Technological Advancement

- Balanced Regional Development

Challenges in Promoting Non-Oil Exports

- Infrastructure constraints

- Government Policies, Corruption, Tariffs and Trade Restrictions

- Multiple Taxation, High-Interest Rates and Limited Collateral Options

- High Production Costs

- Technology Gaps and Digital Literacy

Case Studies: Countries with Effective FX Management and Export Promotion Strategies

South Africa

Although South Africa is heavily reliant on mineral exports, the nation also exports oil and has long recognized the need to diversify its economy and promote exports of other commodities.

The South African Government has implemented various policies and initiatives to stabilize the FX exchange rate in multiple sectors, such as agriculture, tourism, infrastructure, transportation, and, most significantly, the service industry.

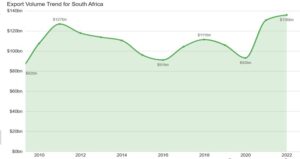

South Africa Export Volume 2010-2022

- The Department of Trade, Industry, and Competition has established One-stop shops for permits.

- Incentivized companies to reinvest profits into expanding their export capabilities with tax breaks.

- Reducing upfront costs for businesses setting up manufacturing and export-oriented operations.

The government has simplified customs procedures, reduced trade barriers, and invested in infrastructure like ports and logistics to make exporting more accessible. Designated areas with tax breaks, streamlined regulations, and improved infrastructure attract foreign investment and promote export-oriented industries.

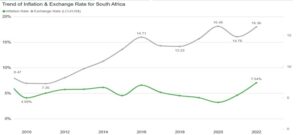

South Africa Inflation and Exchange Rate Trend 2010-2022

The South African Reserve Bank (SARB) uses interest rates to manage inflation and influence the exchange rate. Although the SARB maintained relatively low prime lending rates (fluctuating between 7% and 10.75%) and repurchasing rates (fluctuating between 3.5% and 7.75%), in May 2023, the prime lending rate and repurchasing rate increased to a 14-year high of 11.75% and 8.25%, respectively.

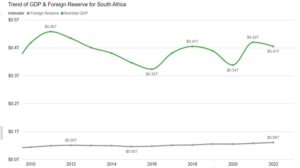

South Africa’s GDP and Foreign Reserve 2010-2022

- The Government has implemented an Export Credit Guarantee Scheme to provide financial guarantees to exporters against non-payment by foreign buyers, reducing risk and encouraging export ventures.

- The government can restrict the movement of capital in and out of the country. This can limit speculative currency trading, which can destabilize the exchange rate. However, capital controls can also hinder foreign investment.

- Maintained a balanced government budget to minimize the need for excessive borrowing, which can put downward pressure on the Rand.

Like Nigeria’s recent FX market, South Africa’s foreign exchange market is not entirely free but leans towards a managed float system. This system offers a balance between market forces and some level of central bank control. It aims to promote a stable and predictable environment for exporters while allowing for some flexibility in response to external economic conditions.

The government implements policies to control government spending, reduce the budget deficit, and attract foreign direct investment.

These long-term initiatives have translated to the booming South African economy of today. South Africa actively participates in free trade agreements and regional economic blocs such as the Southern African Development Community (SADC) to open new markets for its non-oil exports. As of 2010, South Africa was added to the BRICS bloc and recognized as one of the top emerging economies in the world.

These policies have attracted foreign capital inflows and strengthened the Rand (South African currency), making South Africa an ideal destination for investors. South Africa has maintained a relatively low exchange rate against the dollar and other foreign currencies, steadily rising from R7.19 in 2004 to the current rate of about R18.7/$1.

India

India has built enough processing capacity over the years to create various petroleum products despite its reliance on imports. As a result, India is a net exporter of petroleum products.

India recognizes the importance of diversifying its exports beyond oil and has implemented various policies and initiatives.

- Scheme for Reduction in Transaction Costs

- Make in India Initiative: The government of India launched a campaign on 25th September 2014, which aimed to make India the largest manufacturing hub in the world. The manufacturing sector in India contributes to almost 15% of the total GDP. The government wishes to raise it to 25% in the later years with ‘Make in India’ aid.

This campaign focuses on 25 sectors of the economy: automobiles, automobile components, aviation, biotechnology, chemical, construction, defense manufacturing, electrical machinery, electronics, pharmaceuticals, ports, systems, food processing, IT and BPM, leather, media and entertainment, railways, renewable energy, roads and highways, space, textile garments, thermal power, tourism and hospitality, wellness, mining, oil and gas.

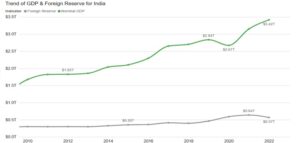

India’s GDP and Foreign Reserve 2010-2022

The results were a decrease in unemployment – lowering the amount spent on unemployment benefits while raising tax revenue from employed people. India’s GDP expanded by 7.2% in 2017-18, increasing manufacturing initiatives and income streams for poor and middle-class Indians and raising their living level. The growing market size and productivity have prompted domestic and foreign investment in secondary sector enterprises. Furthermore, efforts such as ‘Make in India’ have pushed enterprises to employ Indian raw resources, stimulating the economy.

- The e-Biz Mission Mode Project India: The Government of India’s Ministry of Commerce & Industry initiated the eBiz portal on 28.01.2013 to enhance the business environment and ease of business there. This portal offers License and Permits Information Services, enabling enterprises to access customized lists of licenses, permits, and regulations from Central, State, and Local governments. Two additional services, ‘Issuance of Industrial License’ and ‘Issue of Industrial Entrepreneur Memoranda,’ were launched on 20.01.2014. eBiz operates as an online single-window system, providing efficient government-to-business (G2B) services and saving time, effort, and costs for businesses across manufacturing, information technology, and construction services. Several states, including Odisha, Punjab, Rajasthan, Uttar Pradesh, Gujarat, and West Bengal, have been included in the pilot phase of the eBiz project.

The project provides information on licenses, permits, registrations, and other compliances throughout a business lifecycle, offers online filing and payment options for certain services, and provides a single window for accessing G2B services across Central, State, and local government levels.

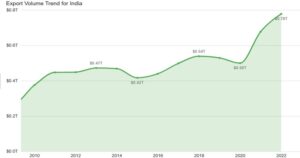

India Export Volume 2010-2022

India has signed 13 Regional Trade Agreements/Free Trade Agreements (FTAs) with various countries and regions to improve market access for Indian goods in international markets. Some of the country’s major trade partners include Japan, Singapore, Malaysia, Thailand, South Korea, Australia, and others.

India is also a member of the BRICS bloc and is involved in agreements between other BRICS nations (as well as the New Development Bank).

- Reserve Bank of India (RBI) Interventions: The RBI, India’s central bank, buys and sells foreign currency in the market to affect the exchange rate and preserve stability.

- Foreign Exchange Reserves: India accumulates foreign exchange reserves to cushion against unexpected exchange rate swings.

- Capital Account Management: The RBI may limit capital inflows and outflows to mitigate their impact on the currency rate.

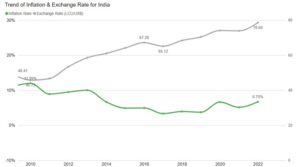

These actions, among others, have caused the inflation rate measured by the consumer price index (CPI) to ease to 5.10% in January 2024 from 5.69% in December 2023, according to the Ministry of Statistics and Programme Implementation. India’s foreign exchange reserves rose to a more than two-year high of $636.10 billion in 2024.

Changes in foreign currency assets are caused by the RBI’s intervention and the appreciation or depreciation of foreign assets held in the reserves. Foreign exchange reserves include India’s reserve tranche position in the International Monetary Fund.

The foreign exchange data currently pertains to the rupee’s trades against the dollar in a range of $1/82.7 INR and $1/82.9 INR. Although the exchange rate has steadily risen, it is undisputed that India’s steps have evolved the Indian economy to a powerhouse in the South Asian region.

India Inflation and Exchange Rate 2010-2022

The domestic currency settled at 82.8775 from March 2024, down about 0.1% for the week, its first week-on-week decline since mid-February.

Recommendations for Balancing FX Stability and Non-Oil Export Promotion in Nigeria

Based on the case studies, the Nigerian government is recommended to adopt various strategies to balance FX market stability with export promotion:

- Unify Exchange Rates: Nigeria should continue to work toward unifying its exchange rates, as it did recently, by consolidating rates into the Investors and Exporters (I&E) window. This shift toward a free-floating currency rate system will significantly promote market transparency and attract foreign exchange.

- Reduce Parallel Market Activity: Reduce parallel market activity by improving access to foreign exchange via legitimate channels. This can be accomplished by increasing liquidity and removing barriers that prevent individuals and businesses, particularly those in the export industry, from acquiring FX at competitive rates.

- Central Bank actions: Following the Central Bank of Nigeria’s proactive actions in the FX market to stabilize the currency and attract foreign exchange, other recommended moves include modifying currency rates, imposing risk-management laws, and eventually liberalizing the market.

- Export Credit Guarantee plan: Create a comparable plan to protect non-oil exporters from nonpayment by international purchasers. This can lower risk perception and stimulate more export operations, producing more non-oil export revenues.

- Invest in Infrastructure: Address issues with the port’s ineffective operations, erratic electricity supplies, and transportation networks. Infrastructure development can increase export competitiveness, reduce manufacturing costs, and attract foreign capital for export-oriented businesses.

- Adopt policy changes that will improve the business climate, reduce bureaucracy, lessen corruption, reduce double taxation, and address the historical dependency on oil money. Simplifying rules and improving the ease of doing business can promote export diversification and the expansion of non-oil sectors.

- Encourage Export-Oriented Industries: Learn from the prosperous export marketing initiatives of nations such as India and South Africa. Promote investment in industries focused on exports by offering tax advantages, incentives, streamlined customs processes, and assistance with manufacturing capabilities.

- Digital Transformation: To close the gap in technology and boost export competitiveness, invest in research, innovation, and digital literacy. To expedite export procedures, digital platforms should be used for trade facilitation, documentation, and G2B service access.

- Participate in Regional Trade Agreements: To boost intra-African trade and broaden export markets within the ECOWAS subregion, actively participate in regional trade agreements such as the African Continental Free Trade Area (AfCFTA). There are also opportunities to export goods to the Asian continent.

- Management of Foreign Exchange Reserves: Build up strategically accumulated foreign exchange reserves to protect against unforeseen exchange rate variations and efficiently manage capital flows.

By implementing these recommendations, Nigeria can attain a balanced strategy that supports non-oil exports and economic diversification while fostering FX market stability. There is no magical way to bring down inflation, reduce the exchange rate, attract foreign investors, and boost the economy except by increasing the productivity and output of goods and services.

There is a complex connection between Nigeria’s export promotion and the stability of the foreign exchange market. The challenges non-oil exporters encounter, as well as the continuous volatility in the foreign exchange market, highlight the pressing need for strategic initiatives. The Central Bank of Nigeria is committed to maintaining currency stability and creating an environment favorable for export-oriented companies, as evidenced by its proactive efforts and recent policy adjustments. Nigeria can use a multipronged approach, taking cues from well-executed policies in South Africa and India that involve coordinating currency rates, improving infrastructure, fostering digital transformation, and aggressively engaging in regional trade agreements. By implementing these suggestions, Nigeria may strike a careful balance that promotes economic diversification, bolsters non-oil exports, and guarantees long-term stability in the foreign exchange market.

References: https://docs.google.com/document/d/13mT_trmvSV75SOnH6eknff17jwxBSVWD/edit?usp=sharing&ouid=116545616047071958501&rtpof=true&sd=true